Overview

Clarizen customers whose fiscal year does not start on January 1, can configure their calendar to define their fiscal year.

You can choose between the following options:

- Standard fiscal year

If your fiscal year is based on the Gregorian calendar, but does not start on January 1, you can define a different start date for your fiscal year. - 4-5-4 fiscal year

If your fiscal year is based on the 4-5-4 calendar, you can define a custom fiscal year that meets your needs. The 4-5-4 calendar is mostly used in the retail industry to ensure sales comparability between years by dividing the year into months based on a 4 weeks – 5 weeks – 4 weeks format. Visit the NRF web site to learn more about the 4-5-4 calendar.

Once you define your fiscal year, you can use the fiscal year periods throughout Clarizen in:

- Groupings in reports, dashboards, Gantt, and Roadmap

- View filters in views, and reports

You only need to define the fiscal year once. The year definition is automatically applied to each consecutive year. Fiscal year definition can be easily modified at any time.

Jump to:

- Configuring the Fiscal Year

- Defining a Standard Fiscal Year

- Standard Fiscal Year in Reports

- Defining a 4-5-4 Fiscal Year

Configuring the Fiscal Year

- As a System administrator, navigate to Settings > Global Settings.

- In the Organizational Settings section, click Edit next to the Calendar setting.

- In the Calendar window, click Calendar settings.

Defining a Standard Fiscal Year

To configure a standard fiscal year:

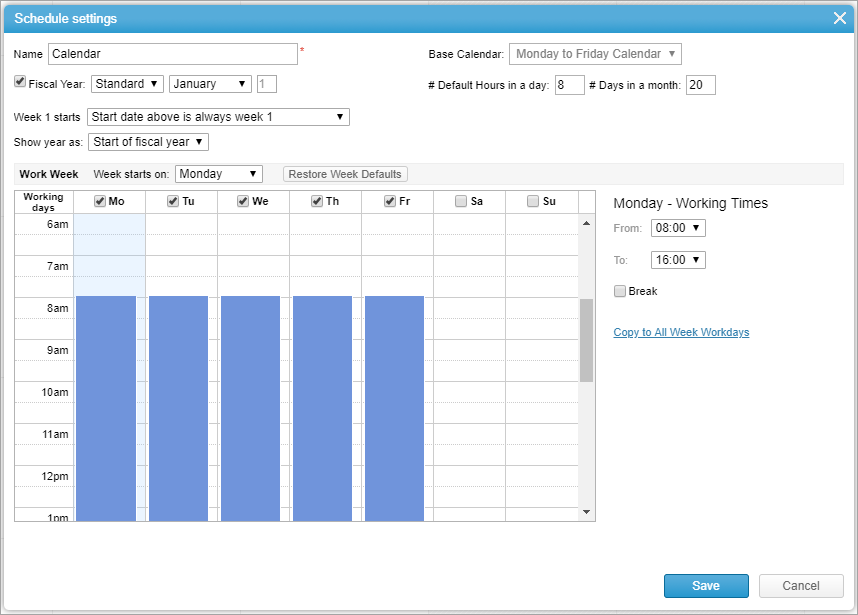

- In the Calendar settings window, enter a name for the fiscal year.

- Select the Fiscal Year checkbox.

- Select the Standard option from the drop-down list.

- Select the year’s start month. The fiscal month will always start on the first day of the month.

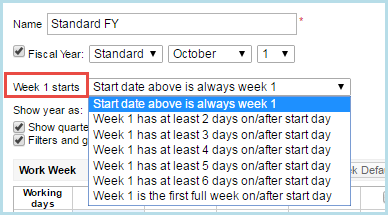

- From the Week 1 starts drop-down list, select an option that defines the start of the first week of the year in case the first day falls on a weekend or a holiday.

- From the Show year as drop-down list, select the desired option to define whether the fiscal year name (as it appears in grouping and views) is based on the year in which it begins or ends.

- Click Save.

Standard Fiscal Year in Reports

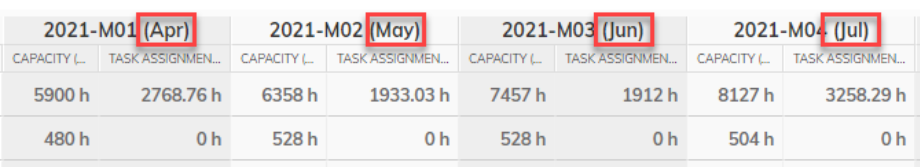

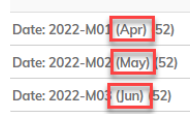

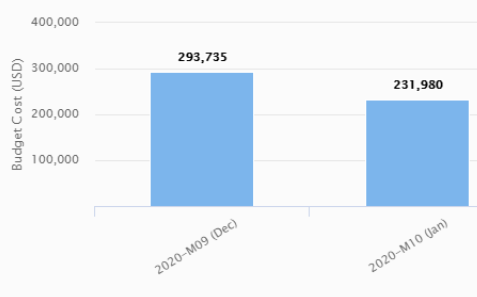

The fiscal month number and corresponding month name appear in reports:

- when grouping by months:

- when grouping by date:

- and in chart labels:

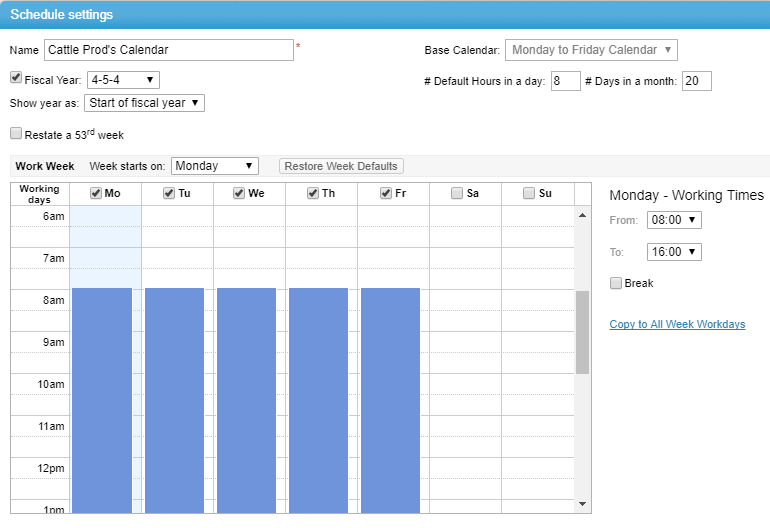

Defining a 4-5-4 Fiscal Year

To configure fiscal year based on the 4-5-4 calendar:

- In the Calendar settings window, enter a name for the fiscal year.

- Select the Fiscal Year checkbox and then select the 4-5-4 option from the drop-down list.

- From the Show year as drop-down list, select the desired option to define whether the fiscal year name (as it appears in grouping and views) is based on the year in which it begins or ends.

- Select the Restated checkbox if you wish to add a 53rd week to the end of a fiscal year.

The 4-5-4 calendar divides the year into months based on a 4 weeks – 5 weeks – 4 weeks format. Due to the layout of the 4-5-4 calendar (52 weeks x 7 days = 364 days), there is one unaccounted day each year. As a result, a 53rd week is added every 5 or 6 years.

If you select the checkbox, the system will automatically add the 53rd week to the end of the appropriate year. - Click Save.

Note: To avoid confusion, Gregorian calendar month labels do not appear in non-standard fiscal calendars (such as 4-5-4), in the Financial Planning module.

Comments