This page describes the project budget and includes the following sections :

- Work Driven Financial Calculations

- Project Expenses

- Reporting Expenses

- Billable Expenses

- Budget Status Indicator

- Financial Fields

Work Driven Financial Calculations

Cost/Revenue from the Project Work Plan

If you have cost and revenue Rates defined in Clarizen and have a work item , say a task that'sbillable; cost and revenue rates of resources assigned to the task factor into the Expected Cost and Expected Revenue of the task according to the work * resources rates.

Once the work is being delivered, the Actual Effort field updates, causing the Actual Cost and Actual Revenue fields to update according to the Actual Effort * Resource Rates (which can have a higher overtime rate factored in too, which is why the Timesheets module overtime can be defined).

If you are not using Rates in Clarizen, enter in your Budgeted Cost and Expected Revenues manually.

You can also do this by setting your Fixed Cost , which updates the Budgeted Cost .

Even if you are using Rates; when you set a Fixed Cost it overrides the calculated Budgeted Cost .

Note that costs and revenues roll up from the tasks to the project, however, if you manually set the actuals at the project level, it blocks the said rollup.

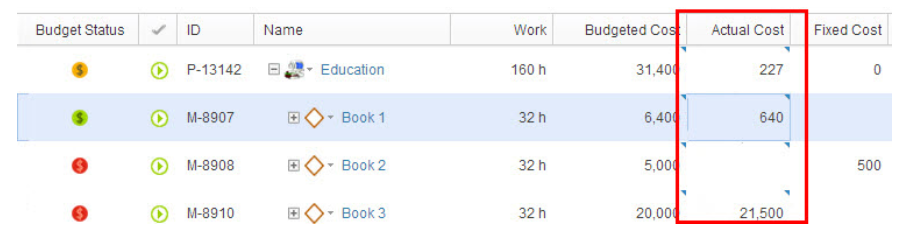

In the example in Figure 1 b elow, the manually set $227 is blocking the roll up of the $640 and $21,500.

Notice that Fixed Cost does not roll up directly, but rather as it is affecting the Budgeted Cost , you’l see it factored in there.

Figure 1: Roll up Blocked

High Level Budget

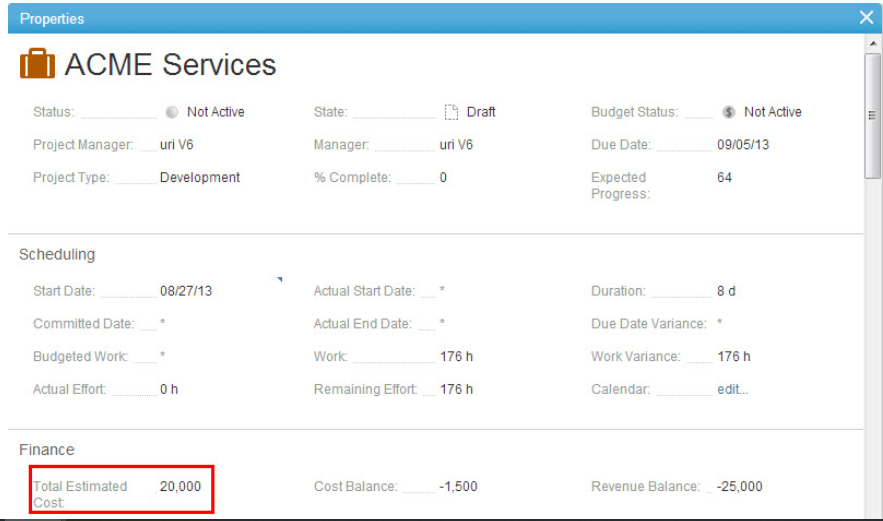

If you want to set a high level budget for your project which is independent of any work or expense calculations, then you should use the Total Estimated Cost field.

Figure 2: Total Estimated Cost

Project Expenses

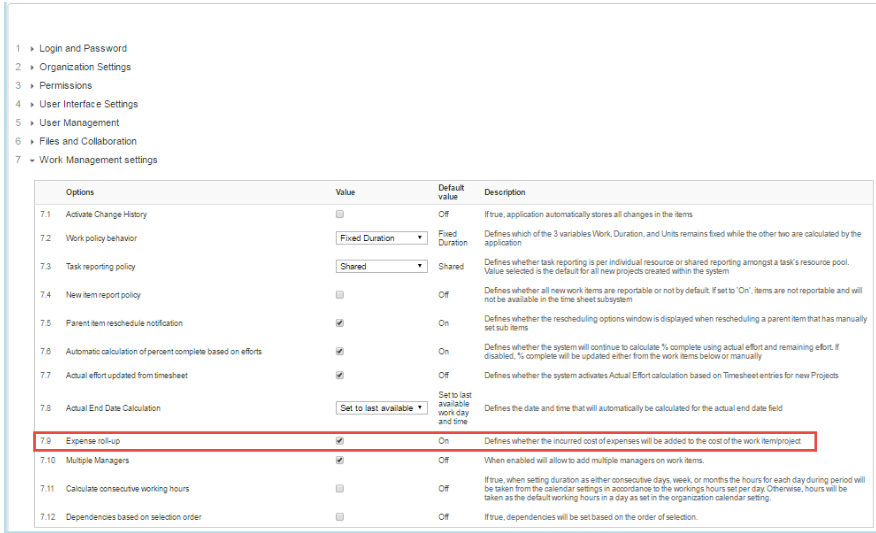

The Expense roll-up system setting defines whether the incurred cost of expenses are added to the cost of the work item/project.

Figure 3: Expenses in System Settings

If you do want this, then, like the parallel process with Clarizen Timesheets, if you also have an approval process, you only see the effect on the project's financials once expenses have been approved.

Checking this box means that once you’ve added expenses and had them approved, you can see the updates in the Finance tab of the related task or project with the expense-specific information in the Expenses sub-Tab.

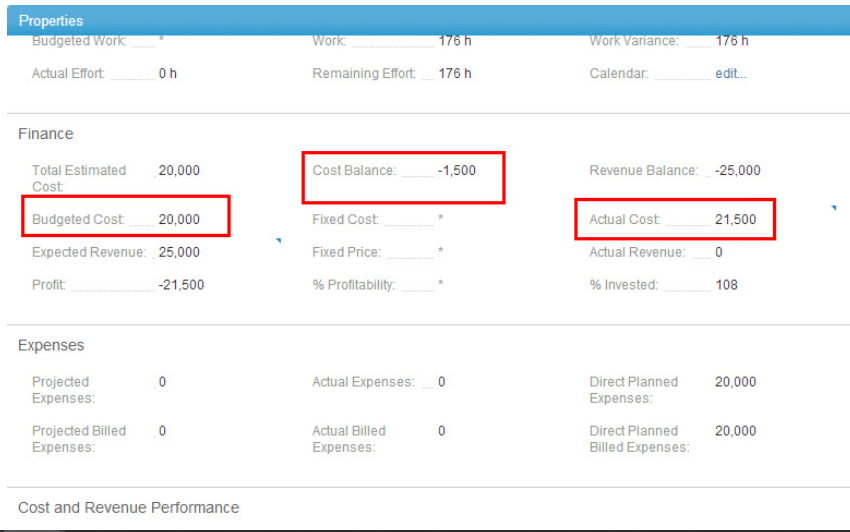

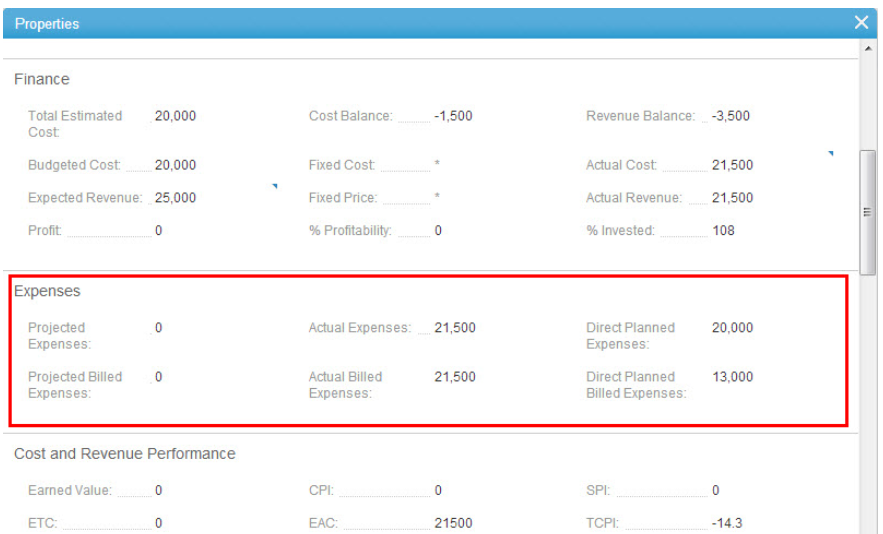

See below how the $21,500 Actual Expenses feed into the Actual Cost and, as they exceed the Budgeted Cost you can see the Cost Balance is negative (-$1,500), over 100% has been invested and the Budget Status is considered Off Track .

Figure 4: Actual Expenses Exceed Budgeted Cost

Planning Expenses

You can add Planned Expenses into a project and into an individual task. Here we can see that I have Direct Planned Expenses on the project as a project (for example, admin cost, rental overheads), but the Planned Expenses shows me the Direct Planned Expenses of any tasks in that project + the Direct Planned Expenses of the project.

Figure 5: Planning Expenses

Reporting Expenses

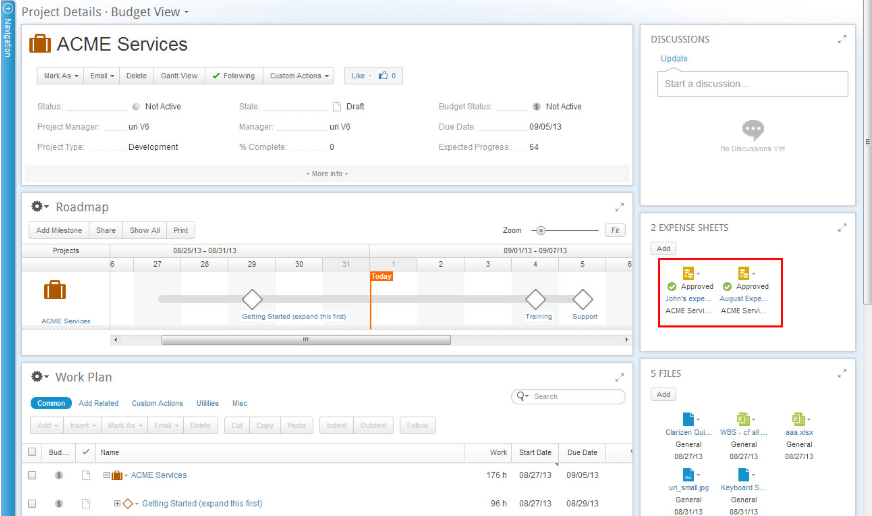

The simplest way to add expenses are via the side panel, by either going to an existing Expense Sheet or adding a new Expense Sheet .

You may want to add a new Expense Sheet if previous Expense Sheets have already been approved, which normally indicates that any financial processing requests have been sent to your Finance team.

Figure 6: Reporting Expenses

Billable Expenses

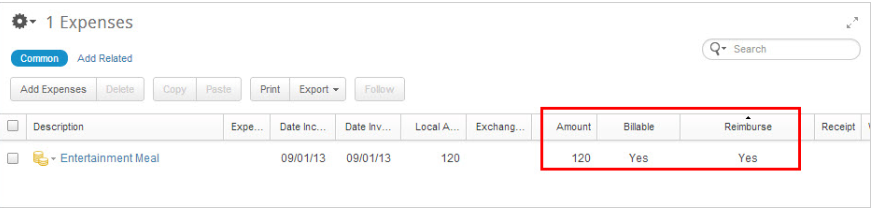

The Figure below shows we spent $120 on a client entertainment meal; luckily they agreed to cover the cost so our expense is billable and our $120 is considered as both a cost and revenue.

Figure 7: Billable Expenses

Notice that there’s also a Reimburse toggle on an expense, however this is not used by any project calculations, yet it is in the User Expense Summary report for payroll purposes.

If your expenses are billable, they are also considered as revenue.

Notice the the Actual Expenses, in the case where we spent on client entertainment, is used in both Actual Cost and Actual Revenue calculations.

Budget Status Indicator

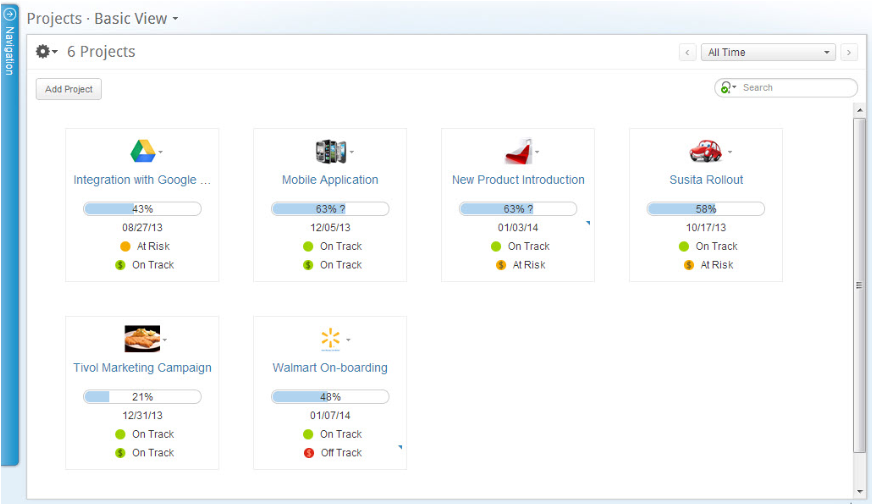

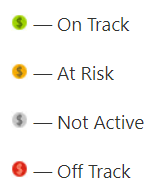

The budgetary status of work items is displayed with a green, orange or red colored icon, representing a status of On Track, At Risk or Off Track.

Notice that it is highly visible as one of the 2 'Traffic lights' (Red – Orange– Green) indicators used on the default projects thumbnail view on the Projects module.

Figure 7: Budget Status Indicators

Budget Status is not visible if you do not have Financial permissions.

If your project is in Requested, Draft or Canceled state, the indicator will show as inactive, gray colored.

The budgetary status of work items is displayed as follows:

For work items with no sub-items, budget status is calculated as follows:

- Off Track = If CPI (Cost Performance Index) is less than: 1-({Remaining Efforts/ [Actual Efforts+ Remaining Efforts]}*0.1)

- At Risk = If 1-({Remaining Efforts / [Actual Efforts+ Remaining Efforts]}*0.1) less than the CPI and CPI is less than 1

- On Track = If the CPI is greater than or equal to 1

For "hammock" work items (parent work items), budget status is calculated as follows :

- Off Track = If calculation above for all leaf items is Off Track

- At Risk = If calculation above for leaf items is not Off Track, AND at least one sub item's budget status is NOT On Track

- On Track = If calculation above for leaf items is On Track AND all sub item's budget status are On Track

CPI — The Cost Performance Index (CPI) measures the actual cost efficiency of a Work Item. CPI is a read only field that automatically calculates EV/actual cost, that is: (budgeted cost * %completion) / actual cost

Earned Value — The Earned Value (EV) is used to measure the progress of a work item by calculating how much of the budget has been used in a work item at any given time.

Earned Value is a read only field that automatically calculates the budgeted cost * % complete.

Financial Fields

This page describes Clarizen's financial fields and includes the following sections:

- About Financial Fields

- Calculate Financials setting

- Standard Finance Fields

- Cost Performance Tab

- Revenue Performance Tab

- Expenses Tab

- Aggregated Financial Planning Time-phased Fields

About Financial Fields

Work item financial fields can only be viewed by Financial users and are therefore dependent on the permission levels defined accordingly (whereby internal users must have financial permissions).

Financial users can access the financial fields either by creating views with dedicated column sets, or by viewing work item Properties Cards .

Calculate Financials

Make sure you are calculating financial settings for the Project. You can find the setting under the Project's Finance Settings.

The default setting is based on the Projects are Billable by default system setting, which is off by default.

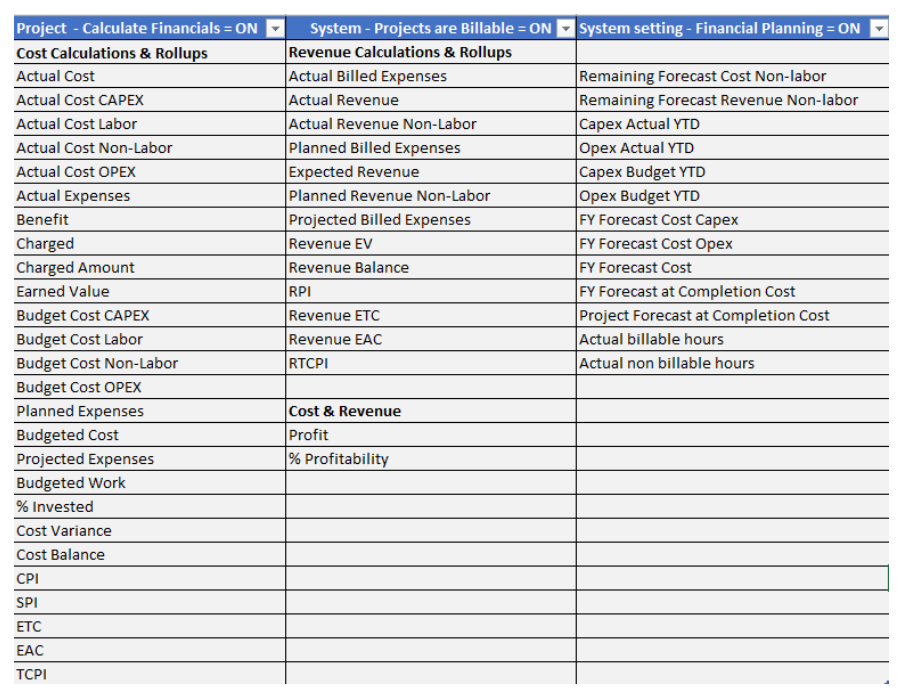

The following table shows which fields are calculated for each of the fields (this setting, and the system settings for calculating financials in projects and the Financial Planning system setting).

Standard Finance Fields

The following fields are standard Finance fields:

Total Estimated Cost

This field is manually entered and represents the Estimated Overall cost of completing the work item.

Budgeted Cost

This field is rolled up from sub work items within the work item.

Where budgeted cost is calculated using the cost rate linked to resources , or fixed cost.

Alternatively, this field can be manually entered by the Financial user assigned to the work item.

Expected Revenue

This field is automatically rolled up from billable sub work items of a billable work item.

Where expected revenue is calculated using the billing rate linked to resources, or fixed price.

Alternatively, this field can be manually entered by the Financial user assigned to the work item.

Fixed Cost

The fixed cost is a manually entered field that represents a fixed cost on a work item (doesn't take into account the assigned resources cost rates).

If this field is entered, it overrides the budgeted cost of the specific work item.

Fixed Price

The fixed price is a manually entered field that represents a fixed price on a work item (doesn't take into account the assigned resources billing rates).

If this field is entered, it overrides the expected revenue of the specific work item.

Actual Cost

The actual cost is an automatically calculated field that takes into account the actual progress completed on a each individual work item, and then rolled up into the parent objects.

Actual cost is calculated by multiplying the actual effort by the cost rates of the individual employees assigned to a task.

This field can be manually updated by a Financial user within a work item.

Actual Revenue

The actual revenue is an automatically calculated field that takes into account the actual progress completed on a each individual billable work item, and then rolled up into the Billable parent objects.

Actual revenue is calculated by multiplying the actual effort by the billing rates of the individual employees assigned to a task.

This field can be manually updated by a Financial user within a work item.

Cost Balance

This is an read only field that automatically calculates the budgeted cost - actual cost

Revenue Balance

This is a read only field that automatically calculates the actual revenue - expected revenue

Profit

This is a read only field that automatically calculates the profit of a work item or the actual revenue - actual cost

% Profitability

This is a read only field that automatically calculates the % profitability or the (profit/actual revenue) * 100

% Invested

This is a read only field that automatically calculates the actual investment in the work item or (actual cost/budgeted cost) *100

Target Margin

% field for Project. Not calculated.

Project Managers can set this value to track against.

% Complete Labor Cost

% of delivery costs (Actual Cost Labor / Budget Cost Labor) that has been completed.

Unlike % Invested, it does not include Non-Labor Costs

Unlike % Complete, it can not be set by resources.

Can go over 100. Can be a virtual field as the component fields are already calculated.

Budget Billable 3rd Party Cost

Budget Cost of 3rd Party Billable Non-Labor Resources

Expected Net Revenue

Expected Revenue - Budget Cost of Billable 3rd party NLRs

Note: This is different from Planned Profit which is Expected Revenue - Budget Cost. In this case, we are only removing the Cost of Billable 3rd Party Costs.

Budget Cost Labor

Work Hours * Cost Rates

Planned Profitability %

(Expected Revenue - Budgeted Labor Cost)/ Expected Revenue

Budget Non-Billable 3rd Party Cost

Budget Cost of 3rd Party Non-Billable Non-Labor Resources

Budget Labor & Non-Billable 3rd Party Cost

Budget Cost Labor + Budget Non-Billable 3rd Party Cost

Planned Profit

(Expected Net Revenue - Billable 3rd Party NLR Costs - Budgeted Labor Cost - Non-Billable 3rd Party NLR Costs)

Planned Contribution %

(Planned Profit / Expected Net Revenue) * 100

Suggested Revenue

If Project's Labor Budget = Task Assignment, use Work*Rates.

If Project's Labor Budget = Project Assignment, use Project Assignment* Rates

Suggested Net Revenue

Labor = Work * Rates.

Non-labor = planned profit of billable non labor

Actual Cost 3rd Party Billable Non-Labor

Actual Cost of 3rd Party Billable Non-Labor Resources

Actual Net Revenue

Actual Net Revenue = Actual Revenue - Actual Cost of Billable 3rd party Non-Labor Resources

Actual Cost Labor

Timesheet Hours * Cost Rates

Actual Non-Billable 3rd Party Cost

Actual Cost of Non-Billable 3rd Party Non-Labor Resources

Actual Cost Labor + Non-Billable 3rd Party

Actual Cost Labor + Actual Cost of Non-Billable 3rd Party Non-Labor Resources

Actual Contribution

Actual Net Revenue - Actual Labor Cost - Actual Non-Billable 3rd Party Costs

Actual Contribution %

(Actual Contribution / Actual Net Revenue) * 100

Cost Performance Tab

The fields located in the Cost Performance tab measures the efficiency of a work item based on the actual and planned costs.

Earned Value

The Earned Value (EV) is used to measure the progress of a work item by calculating how much of the budget has been used in a work item at any given time.

This is a read only field that automatically calculates the budgeted cost * %completion

The Earned Value (EV) calculation for projects calculates the sum of all EV calculations of the sub-items associated with the project.

CPI

The Cost Performance Index (CPI) measures the actual cost efficiency of a work item.

This is a read only field that automatically calculates EV/actual cost

SPI

The Schedule Performance Index (SPI) measures the progress and efficiency of a work item.

This is a read only field that automatically calculates EV/(Budgeted Cost*Expected Progress)

ETC

The Estimate to Complete (ETC) is used to determine what the expected cost of completing the work item will be.

This is a read only field that automatically calculates (budgeted cost-EV)/(CPI*SPI)

EAC

The Estimate at Complete (EAC) is used to determine what the expected overall costs of a work item will be upon completion.

This is a read only field that automatically calculates actual cost + ETC

TCPI

The To Complete Performance Index (TCPI) measures the expected cost efficiency of a work item at it's completion.

This is a read only field that automatically calculates (EAC - EV)/(budgeted cost - actual cost)

Cost Variance

The Cost Variance measures the difference between the earned value and the actual cost.

This is a read only field that automatically calculates EV - actual cost

Revenue Performance Tab

The fields located in the Revenue Performance tab measures the efficiency of a work item based on the actual and planned revenues.

Revenue EV

The Revenue Earned Value (Revenue EV) is used to measure the progress of a work item by calculating how much revenue is expected in a work item at any given time.

This is a read only field that automatically calculates budgeted revenue * %completion

The Revenue Earned Value (Revenue EV) calculation for projects calculates the sum of all Revenue EV calculations of the sub-items associated with the project.

Revenue EAC

The Revenue Estimate at Complete (Revenue EAC) is used to determine what the expected overall revenue of a work item will be upon completion.

This is a read only field that automatically calculates actual revenue + revenue ETC

Revenue ETC

The Revenue Estimate to Complete (Revenue ETC) is used to determine what the additional expected revenue of a work item will be at its completion.

This is a read only field that automatically calculates (expected revenue- revenue EV)/(RPI*SPI)

RPI

The Revenue Performance Index (RPI) measures the actual revenue efficiency of a work item.

This is a read only field that automatically calculates revenue EV/actual revenue

RTCPI

The Revenue to Complete Performance Index (RTCPI) measures the revenue that will be required to meet the projected revenue expectations upon completion of the work item.

This is a read only field that automatically calculates (revenue EAC - revenue EV)/(expected revenue - actual revenue).

Expenses Tab

The Expenses tab gathers data of all expenses from within a work item, which is then rolled up into the parent work item.

Planned Expenses

Sum of all expenses planned for a work item and sub-items.

This is a read only field that automatically calculates the 'Direct Planned Expenses' of the work item and all of its sub-items.

Direct Planned Expenses

Enables you to manually enter the planned expenses of the specific work item.

This field will be used to calculate the "Planned Expenses"

Planned Billed Expenses

Sum of all planned billed expenses for a work item and sub-items.

This is a read only field that automatically calculates the "Direct Planned Billed Expenses" of a work item and all of its sub-items.

Direct Planned Billed Expenses

Enables you to manually enter the planned billed expenses of the specific work item.

This field will be used to calculate the 'Planned Billed Expenses'.

Actual Expenses

Sum of all approved expenses that are related to a work item and sub-items.

This is a read only field that is automatically calculated by summing up all the approved expenses of a work item and its sub-items.

Projected Expenses

Sum of all expenses that have not yet been approved that are related to the work item and sub-items.

This is a read only field that is automatically calculated by summing up all the submitted (not yet approved) expenses of a work item and its sub-items.

Actual Billed Expenses

Sum of all expenses that are both billable and approved that are related to the work item and sub-items.

This is a read only field that is automatically calculated by summing up all the approved billable expenses of a work item and its sub-items.

Project Billed Expenses

Sum of all expenses that are billable and not yet approved that are related to the work item and sub-items.

This is a read only field that is automatically calculated by summing up all the submitted (not yet approved) billable expenses of a work item and its sub-items.

Aggregated Financial Planning Time-phased Fields

Remaining Forecast Cost Non-labor

Forecasted Non-Labor amount for this Work-Item and its sub-Work Items, for current month onwards

Total Forecast Revenue Non-labor

Remaining forecasted Non-Labor amount for this Work-Item and its sub-Work Items, for current month onwards

Capex Actual YTD

Actual Capex cost from start of fiscal year until end of previous month (from labor and non-labor)

Opex Actual YTD

Actual Opex cost from start of fiscal year until end of previous month (from labor and non-labor)

Capex Budget YTD

Budgeted Capex cost from start of fiscal year until end of previous month (from labor and non-labor)

Opex Budget YTD

Budgeted Opex cost from start of fiscal year until end of previous month (from labor and non-labor)

FY Forecast Cost Capex

Actual Capex cost from start of fiscal year until end of previous month (from labor and non-labor) + forecast starting from current month until the end of the fiscal year

FY Forecast cost Opex

Actual Opex cost from start of fiscal year until last full month (from labor and non-labor) + + forecast starting from current month until the end of the fiscal year

FY Forecast Cost

FY Forecast Cost Capex (see above) + FY Forecast cost Opex (see above)

FY Forecast at Completion Cost

Total forecast for the entire year

Project Forecast at Completion Cost

Total forecast for the entire project timeline

Actual Billable Hours

Billable labor hours

Actual Non-billable labor hours

Non-billable labor hours

FY Budgeted Cost

Current Fiscal Year Budgeted Cost. Rollup of Budget Cost in Financial Plan

FY Budgeted Cost Capex

Current Fiscal Year Budgeted Cost Capex. Rollup of Capex Budget Costs in Financial Plan

FY Budgeted Cost Labor

Current Fiscal Year Budgeted Labor Cost. Labor Cost calculated from Task or Project Assignment as per project Labor Budget setting

FY Budgeted Cost Non-labor

Current Fiscal Year Budgeted Non-Labor Cost. Rollup of Budget Cost for Non-Labor in Financial Plan

FY Budgeted Cost Opex

Current Fiscal Year Budgeted Cost Opex. Rollup of Opex Budget Costs in Financial Plan

FY Expected Revenue

Current Fiscal Year Expected (Planned) Revenue. Rollup of Budget Revenues in Financial Plan including, Labor, Non-Labor and Fixed Price items

FY Expected Revenue Labor

Current Fiscal Year Expected (Planned) Revenue. Rollup of Budget Revenues in Financial Plan for Labor Resources

FY Forecast Revenue

Current Fiscal Year Forecast Revenue from financial plan

FY Planned Profit

FY Budget Revenue - (minus) FY Budget Cost

Setting up Project Specific Rates & Prices

Initial rates and prices are inherited from the organizational level, but can be defined at the Job Title and user levels. See Costs and Billing Rates.

In addition Clarizen allows a Financial user to define project-specific billing rates and prices, used for calculations of the project prices based on the time tracking reports.

You can also:

- change resource hourly rates for specific work items (Project, Milestone, Task)

- Modify the resource's job title in a specific work item

- Define a fixed price of a specific work item

You can access Prices and Rates settings from the Resources tab in the Work Plan.

See also Date-effective Cost and Billing Rates.

Comments